You may see the SEID number on newer modern devices, phones and tablets. This number is available on phones or tablets that have NFC modules installed or that support contactless payments, such as payment in apps and websites that support Touch ID or Face ID payments. The SEID number is required to identify your device when making contactless payments. The number can be found in the phone’s information, such as on an iPhone. I couldn’t find the SEID number on my Android phone; although it exists, the system doesn’t show it for viewing.

SEID Number Explanation

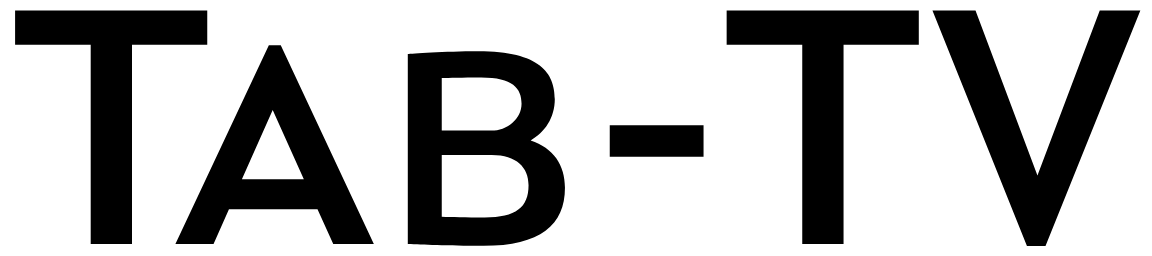

SEID is a (Secure Element Identifier), a unique number that is associated with a device and serves to identify it when making payments. This number cannot be changed and is tied to the hardware. You don’t need this number, you will never use the SEID number by itself, it is very large and contains 48 characters. In the picture below you can see this number in a screenshot from an iPhone.

How is the SEID number used?

If you only use your phone for calls or surfing the Internet, then this number is not used. But if you want to connect contactless payments to your device, you will need a SEID number. A contactless payment system called Apple Pay works with Apple devices. It’s comfortable; Carrying a plastic card with you is unnecessary. You need to link your card to the contactless payment service once, and then you can pay with your phone in stores. When you use your phone to pay, the system will ask you to set a password, fingerprint, or set up Face ID access. In short, you won’t be able to pay from a locked phone. By the way, the SEID number is not only on your phone but also on all devices you can use to pay, such as smartwatches.

So you’ve decided to enable contactless payments on your iPhone; you must register in the system. The next step is to link your bank card to your phone. You connect your bank card to your Apple Pay account. During setup, your phone will provide the service with a SEID number. This will ensure secure payments in the future. The payment system remembers your SEID and your card number. A virtual account is created in which your bank card is registered. The card’s authenticity is verified using a token (one-time password) sent by the bank when linking the card to the service; you will not be able to link a non-existent card. Your account in the payment system is linked to your device via SEID.

How NFC payments are made using SEID

During payment, when you bring your smartphone to the NFC reader in the payment terminal, you can see the amount to pay; it also means that the bank has issued you an invoice and is waiting for payment. Ok, you pay with your phone; before doing this, you unlock the phone, confirming your identity and right to pay. The phone sends the bank a unique code containing information about the amount, virtual account, payment date, SEID number, and a one-time password for the transaction. The payment service verifies the information received and confirms the payment, and the bank, having received confirmation, debits the money from your account.

Payments are made without a card PIN code. Bring your phone to the payment terminal, and the payment will be processed. For added protection, if your payment exceeds the limit, you will be asked to identify yourself by unlocking your phone or rescanning your fingerprint.

If for any reason your iPhone loses its SEID number, you won’t be able to use Apple Pay. This happens sometimes, sometimes electronics break down and one day you may find that your phone has stopped paying in terminals. First of all, check if there is a SEID number. If the number is missing, your iPhone needs to be repaired.

What if you didn’t register or personally active either the SEID or EID?? All my phones have that information and I didn’t do anything for it. I don’t use pay by phone Ever!!!

In most cases, these EIDs and SEIDs are required in certain cases and are read automatically. You do not need this information.